Tag: tax

Renewal energy credit

ENERGY TAX CREDIT FOR RESIDENCES 2016

Thinking about energy credit for your home? Let’s look at the restrictions and limits. All of the improvements for windows, insulation, roofs, doors and skylights are limited to 10% of costs.

There is a further limit to a maximum of $500 for certain improvements. The total credit allowed is cumulative for all years since 2005 through to today in the amount $500 for windows, insulation, roofs, doors, skylights, stoves, furnaces, central air, and water heaters.

So the 1st question you have to ask is how many people have kept track of what they have spent after 2005 – 11 years ago on energy improvements. And certainly the IRS has no way of knowing what you spent in 2006 for insulation, etc.

You may have already taken full advantage of the credits listed for for windows, insulation, roofs, doors, skylights, stoves, furnaces, central air and water heaters. However it is always worth reviewing, especially for new home owners. Congress should reset the time clock. I am sure that with wear and tear on homes in the last 10 years, homeowners should be given an incentive to get up in the attic and put some insulation down, etc. to make their homes more energy efficient.

The good news is for geothermal, wind, fuel cells, and solar energy units there is not dollar limit, and the credit is 30%.

RESIDENTIAL ENERGY PROPERTY COSTS

A. For an existing home that is your principal residence here are the items that you are entitled to a 10% of the money spent towards a energy credit

For example, if you spent $2,500 for energy efficient windows, that cost is limited to $2,000, and if you spent $450 for insulation and another $200 on your roof. Then the total credit would be $265 ($2,000 + $200 + 450 = 2,650 X 10%)

And limited to the following CUMULATIVE since 2005

OVER ALL CREDIT LIMIT $500

LIMIT for Window credit $200

LIMIT for advanced main air circulating fan credit $50

LIMIT for ALL BOILERS & FURNACES credit is $150

LIMIT for Bio Mass stoves, heat pumps, central air conditioning, and hot water heater credit is $300.

If you think about the cost of a water heater being approx $700, then this is a very good credit, but for a furnace that may cost $7,000 a $150 credit is paltry.

Energy-efficient building property Bio Mass Stoves, Heat Pumps, Central Air Conditioning, and Hot Water Heaters

Biomass Stove (burns plant derived fuel to heat your home or hot water) Although wood and wood pellet stoves are most common, biomass fuels includes renewable forms such as corn or even aquatic plants.

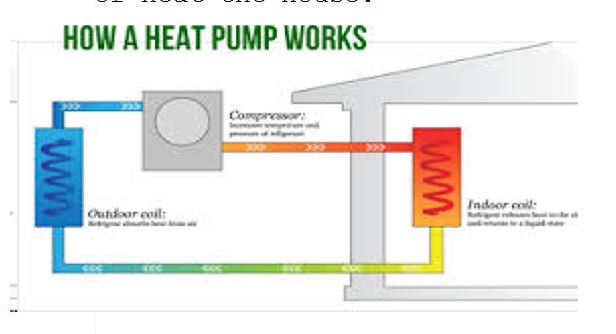

Air Source Heat Pumps. This device absorbs heat in one place and releases it as another either to cool or heat the house.

Maximum credit for Natural Gas, Propane, Oil, and Hot Water Furnaces or Boilers is $150. If there is an advance main air circulating fan then a credit is limited to $50.

Natural Gas, Propane, Oil Furnace or Hot Water Boilers

Gas Propane and Oil Furnaces and Fans

QUALIFIED ENERGY EFFICIENCY IMPROVEMENTS – ROOFS, WINDOWS, SKYLIGHTS, AND DOORS. Remember costs are multiplied by 10% to calculate credit.

Insulation

Roofs

Must meet

Energy Star req.

Windows, Doors & Skylights

Must meet Energy Star requirements

Maximum cost is $2,000 X .10 is $200.

RESIDENTIAL ENERGY CREDITS

B. For principal residence for either new or existing construction the following

Credit is 30% of cost with no limits

Fuel Cells. A machine that creates electricity by the interacting of hydrogen and oxygen.

There is a limit to the lower of 30% of the cost or the Kilowatt capacity X 1,000. So if you buy a Fuel cell system for 10,000 and it has a Kilowatt capacity of 2. The lower amount will be 2 X 1,000 or $2,000 and not the 3,000 amount ($10,000 X 30%)

C. For both new homes and existing homes qualify – and principal residence and 2nd homes qualify.

30% of cost with no limit on the following:

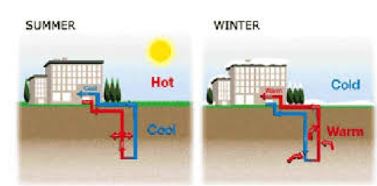

Geothermal Heat Pumps

Small Wind Turbines (Residential)

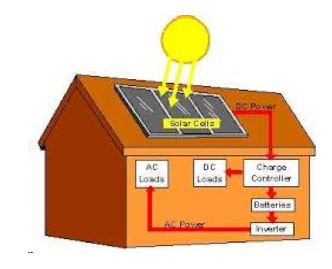

Solar Energy Systems (Water or Heating)

The IRS form to claim a credit is form 5695. As typical these credits are subject to almost yearly renewal. So you may want to do energy conservation in 2016 because you don’t know is Congress will renew. The one exception is for Geothermal, Wind, and Solar the 30% credit is through 12/31/19, and then is reduced to 26% for 2020,and then drops to 22% in 2021 the final year.

Can a 1041 tax return fiscal year filing end on any day of the year?

Can an Estate choose any day of the year to end its fiscal year in filing the 1041 tax return?

An Estate can choose a fiscal year for a year end. But can an Estate choose any day of the year for a year end What if you are trying to close the estate in one year and not have to incur the cost of preparing a second 1041 tax return?

For example, the death occurs on February 22, 2015, and the client is on February 15th of 2016 just finishing selling stock, collecting dividends, and making the final distributions. Can I elect a February 21, 2016 year end? If not, I would have to choose January 31, 2016, and then a second 1041 would have to be filed.

IRS Publication 559 states, “The estate’s

first tax year can be any period that ends on the

last day of a month and does not exceed 12

months.”

So unfortunately, the estate will have to have a January 31st year end, and a second 1041 tax return will have to be filed for the activity in February.

Also 26 USC §441(e) also answers this same question,

“For purposes of this subtitle, the term “fiscal year” means a period of 12 months ending on the last day of any month other than December.”

When is a debt discharged in bankruptcy?

When is a debt discharged in bankruptcy?

108(1)(1) talks about the exclusion from gross income by reason of discharge of indebtedness of the taxpayer.

The issue is what is the date of the discharge of the indebtedness in a Chapter 7 liquidation. For a large corporate bankruptcy the litigation of whether there is a legitimate debt may go on over a number of years while the corporation is in bankruptcy. Even though the corporation filed in year 1, the ultimate determination of whether the debt is legitimate, and what amount will actually be collected may be many years later. The Trustee may have preference action and fraudulent transfer litigation that goes on for years in trying to collect moneys for the creditors.

Even with a secured debt, the amount of COD may not be known until the Trustee’s final report is approved. For example, a secured creditor, ABC Mortgagee, has a Deed of Trust on a hotel worth 100,000,000. The property is foreclosed on in year 2 at a FMV of 80,000,000. Is the COD 20,000,000? The ABC Mortgagee is unsecured in the amount of 20,000,000. What if there are other assets in the corporation that are being liquidated by the Trustee and in year 4 the Trustee is able out of the remaining liquidated assets to pay the ABC Mortgagee 15,000,000 as an unsecured creditor. Now the COD is only 5,000,000. So what is the date of the discharge of the indebtedness. Year 4? Yes if Year 4 is the final year of the Corporation administration and all the assets have been abandoned, foreclosed, sold, collected, adjudicated, and admin expenses paid. The determination of what moneys are available for all claims is determined only upon the approval of the Trustees final report in year 4 of this example. There is no way of knowing what the final payouts will be until year 4.

In general, a debt is considered discharged at the point when it becomes clear that the debt will never have to be paid. Cozzi v. Commissioner, 88 T.C. 435, 445 (1987). The test for determining that point requires a practical assessment of all the facts and circumstances surrounding the likelihood of repayment of the debt. Id. Any “identifiable event” which fixes the loss with certainty may be taken into consideration. Id. (citing United States v. S.S. White Dental Mfg. Co., 274 U.S. 398 (1927)). The commencement of a bankruptcy proceeding is not an identifiable event. See Friedman v. Commissioner, 216 F.3d 537 (6th Cir. 2000), aff’g T.C. Memo. 1998-196; Alpert v. United States, 481 F.3d 404 (6th Cir. 2007), aff’g 430 F. Supp. 2d 682 (N.D. Ohio 2006). Private Letter Ruling 144654-10.

This issue is critical because under 108(b)(4) the attribute reduction Ordering Rules are made AFTER the year of the taxable year of the discharge. (108(b)(4) uses the word “discharge”, which I believe means “discharge of the indebtedness”, which is a separate issue from the discharge of a debtor and of course corporations never obtain a discharge 11 USC 727(a)(1).)

Reg Sec. 1.6050P-1(b)(2)(i) clarifies the date of discharge and the identifiable event under (b)(2)(i)(A), see below. This section again returns back to the issue of the actual date that it become clear that the debt will not be paid.

b) Date of discharge –

(1) In general. Solely for purposes of this section, except as provided in paragraph (b)(3) of this section, indebtedness is discharged on the date of the occurrence of an identifiable event specified in paragraph (b)(2) of this section.

(2) Identifiable events –

(i) In general. An identifiable event is –

(A) A discharge of indebtedness under title 11 of the United States Code (bankruptcy);

(B) A cancellation or extinguishment of an indebtedness that renders a debt unenforceable in a receivership, foreclosure, or similar proceeding in a federal or State court, as described in section 368(a)(3)(A)(ii) (other than a discharge described in paragraph (b)(2)(i)(A) of this section);

(C) A cancellation or extinguishment of an indebtedness upon the expiration of the statute of limitations for collection of an indebtedness, subject to the limitations described in paragraph (b)(2)(ii) of this section, or upon the expiration of a statutory period for filing a claim or commencing a deficiency judgment proceeding;

(D) A cancellation or extinguishment of an indebtedness pursuant to an election of foreclosure remedies by a creditor that statutorily extinguishes or bars the creditor’s right to pursue collection of the indebtedness;

(E) A cancellation or extinguishment of an indebtedness that renders a debt unenforceable pursuant to a probate or similar proceeding;

(F) A discharge of indebtedness pursuant to an agreement between an applicable entity and a debtor to discharge indebtedness at less than full consideration;

(G) A discharge of indebtedness pursuant to a decision by the creditor, or the application of a defined policy of the creditor, to discontinue collection activity and discharge debt; or

(H) In the case of an entity described in section 6050P(c)(2)(A) through (C), the expiration of the non-payment testing period, as described in § 1.6050P-1(b)(2)(iv).

When is a debt discharged in bankruptcy for a plan of reorganization?

For entities with an approved Chapter 11 plan of reorganization where for example a certain class will not be paid at all, then it is clear the debt will not be paid and the tax attributes will be reduced in the following year. If the approved Chapter 11 plan of reorganization is based on a percentage, then there is still a question on what that exact amount will be. Further, even if the plan allows for a fixed percentage or an amount certain, approximately 90% of all chapter 11 plans are eventually converted to a chapter 7 plan. And of course with the conversion to a chapter 7 plan the amount a creditor may receive can be reduced. Also the amount received can be reduced by the chapter 7 administrative expenses. For a secured creditor the issue would be whether they will have to wait under the chapter 11 plan until all the payments are made, or alternatively whether the plan will default and the secured creditor will be able to obtain a relief from stay and foreclose, and then at what price and when.

So when is a debt discharged in bankruptcy? Certainty in bankruptcy is elusive.

Please see your attorney or tax advisor for your specific legal issues and situation. The above should not be consider legal advice.