2016 YEAR END TAX PLANNING FOR BUSINESSES

Some points to consider as we come to the end of 2016.

1. RETIREMENT PLANS – a great opportunity to reduce your taxes.

A. 401K plans, Defined contributions, Defined benefit plans.

1. Need to be set up before the end of the year.

2. But you have til the due date of the 2016 return (could be extended to 9/15/17 for corps and partnerships) to fund the 2016 liability.

B. Tax credits for setting up retirement plan 1st year start up 50% of startup cost. At least one person in the plan must be a non highly comp employee.

For example, you pay 2,000 to ADP to start your 401K plan. But max credit is $500.

C. The SEP retirement plan can be established and funded in 2017 by the due date of the tax return including any extension.

2. EQUIPMENT – If you need new equipment, this is a good time to buy.

A. 179 expense personal property

New and used property is eligible

B. Bonus depreciation 50% write off

New property only

3. RECORDS. Good record keeping is critical to making sure you capture all of the deductions allowed.

A. Capture your deductions.

1. Checking account business (separate from personal)

2. Credit Card accounts (don’t mix and match)

3. Out of pocket costs cash purchases ( post office staples)

4. Mileage for auto + parking +tolls + actual costs (insurance repairs gas )

5. Office in the home

6. Equipment (desk, phone, lamp) purchased as personal item now used in business.

4. ACCELERATE EXPENSES AND DEFER INCOME. Defer billing in December with the idea that the delay will cause the receipt of payment until 2017.

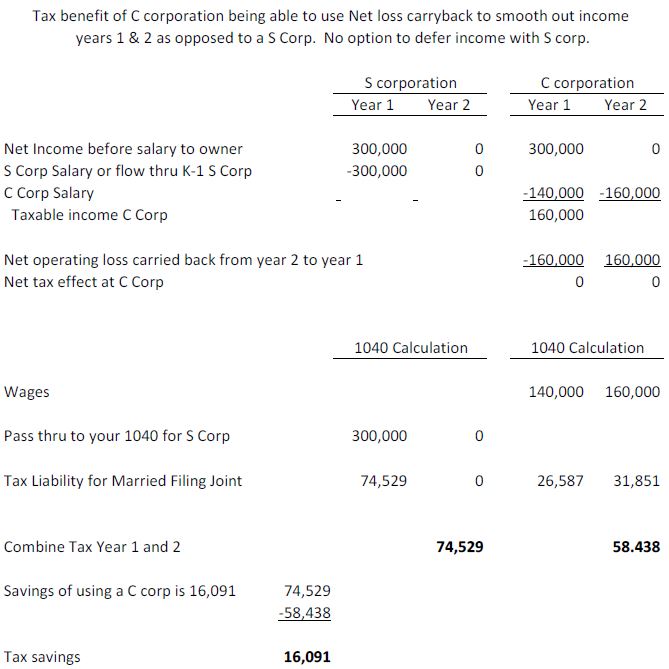

5. REVIEW WHETHER FOR 2017 CHANGE FORM OF BUSINESS ENTITY.

6. AUTO RULES – two methods.

A. Standard 54 cents a mile + parking + tolls. If you want to use standard must elect first year. So your 2000 Ford Taurus needs a new transmission and air conditioning – you can switch to actual.

B. Actual

Once you elect Actual you cannot switch back to standard.

Repairs

Gas

Insurance

Car tax

Interest expense

Depreciation

1. New car 50% Bonus Depreciation max 1st year 8,000 (bonus) + = 11,160

2. Used car not eligible No 50% bonus

Standard depreciation 3,560.

3. 179 New and Used car qualifies (used more than 50% in business)

If your car weighs over 6,000 lbs, eligible for a $25,000 write off

If you car weights under 6,000 lbs then 1st year combined = 3,160 limit.

7. HEALTH CARE INSURANCE CREDIT.

The Small Business Health Care Tax Credit helps small businesses pay for health care coverage they offer their employees. You’re eligible for the credit if:

1. You buy the insurance thru SHOP Marketplace.

2. You have fewer than 25 employees who work full-time, or a combination of full-time and part-time, with average wage < 50K.

3. Pay at least 1/2 of premium.

4. The maximum credit is 50 percent of premiums paid for small business employers.

https://www.healthcare.gov/small-businesses/employers/