When a company is not doing well, the withholding taxes are often not paid. The IRS in such cases can assess the “responsible person” for personal liability. The question becomes whether upon payment by the individual held responsible if that individual can take a deduction on their 1040 for trust fund liabilities.

So, an IRS agent will interview the people at the company who could have paid the withholding tax ( and instead paid suppliers, etc.) and make a determination of who is going to be held personally responsible for not having made the IRS payroll withholding deposits.

That “responsible person” is personally liable for the employee withholding taxes that were not paid. Collection action is then taken by the IRS against that individual.

And assuming the “responsible person” actually makes the payment, the question arises: can the responsible person take a tax deduction on their 1040?

Or, in the alternative, if not allowed an immediate tax deduction, can the responsible person, who is also a shareholder or partner, increase their basis in their stock or partnership interest by the amount of the payment?

A couple of practical points:

1. Most likely the corporation has already taken this same deduction and thus the “responsible person” is attempting taking the same deduction again.

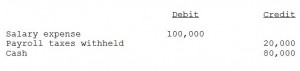

How so? When the business made the entry for payroll it most likely looked like this example:

A. Even a cash basis taxpayer will be on an modified accrual method for payroll and thus accruing the payroll withholding taxes.

B. So in our example, the 20,000 is never paid by the business, and assuming all of the 20,000 is trust fund liability, then the responsible person would be liable.

So, when the “responsible person” tries to deduct the 20,000, the problem is the 20,000 was already included as part of the 100,000 salary deduction taken by the business.

C. The other point is that if the “responsible person”, who is a shareholder or partner, contributed the cash to pay the withholding tax liability of 20,000 before it got to the point of the IRS assessing the individual with the trust fund liability, then the shareholder/partner basis would be increased.

2. The IRC 162(f) specifically denies certain deductions:

(f) Fines and penalties

No deduction shall be allowed under subsection (a) for any fine or similar penalty paid to a government for the violation of any law.

3. Here is a case below where the responsible person argued that he could take a deduction personally as a business bad debt (this would be limited to 3,000 a year or offsetting capital gains) because the corporation agreed to indemnify him.

The Tax Court in Elliott V. Commissioner, 73 T.C.M. 3197 (1997), T.C. Memo 1997-294 states,

Petitioner is not entitled to deduct any portion of this amount. Even if we were to assume that EPC was required to indemnify petitioner for this payment, an assumption which we do not find as a fact, petitioner would be unable to deduct this amount because he paid it in settlement of amounts assessed against him under section 6672. Amounts paid for section 6672 assessments are nondeductible. See sec. 162(f); sec 1.162-21(b), Income Tax Regs; see also Arrigoni v. Commissioner , 73 T.C. 792 (1980); Patton v. Commissioner , 71 T.C. 389 (1978); Smith v. Commissioner , 34 T.C. 1100 (1960), affd. per curiam 294 F.2d 957 (5th Cir. 1961); Duncan v. Commissioner , T.C. Memo. 1993-370, affd. 68 F.3d 315 (9th Cir. 1995).

The answer is “No”, a “responsible person” cannot take a deduction on their 1040. The answer can be “Yes” if a “responsible person” makes the capital contribution to the cash account and pays the taxes before the trust fund liability penalty is assessed.

Please see your attorney or CPA for answers to your particular situation.