Tag: credit

Renewal energy credit

ENERGY TAX CREDIT FOR RESIDENCES 2016

Thinking about energy credit for your home? Let’s look at the restrictions and limits. All of the improvements for windows, insulation, roofs, doors and skylights are limited to 10% of costs.

There is a further limit to a maximum of $500 for certain improvements. The total credit allowed is cumulative for all years since 2005 through to today in the amount $500 for windows, insulation, roofs, doors, skylights, stoves, furnaces, central air, and water heaters.

So the 1st question you have to ask is how many people have kept track of what they have spent after 2005 – 11 years ago on energy improvements. And certainly the IRS has no way of knowing what you spent in 2006 for insulation, etc.

You may have already taken full advantage of the credits listed for for windows, insulation, roofs, doors, skylights, stoves, furnaces, central air and water heaters. However it is always worth reviewing, especially for new home owners. Congress should reset the time clock. I am sure that with wear and tear on homes in the last 10 years, homeowners should be given an incentive to get up in the attic and put some insulation down, etc. to make their homes more energy efficient.

The good news is for geothermal, wind, fuel cells, and solar energy units there is not dollar limit, and the credit is 30%.

RESIDENTIAL ENERGY PROPERTY COSTS

A. For an existing home that is your principal residence here are the items that you are entitled to a 10% of the money spent towards a energy credit

For example, if you spent $2,500 for energy efficient windows, that cost is limited to $2,000, and if you spent $450 for insulation and another $200 on your roof. Then the total credit would be $265 ($2,000 + $200 + 450 = 2,650 X 10%)

And limited to the following CUMULATIVE since 2005

OVER ALL CREDIT LIMIT $500

LIMIT for Window credit $200

LIMIT for advanced main air circulating fan credit $50

LIMIT for ALL BOILERS & FURNACES credit is $150

LIMIT for Bio Mass stoves, heat pumps, central air conditioning, and hot water heater credit is $300.

If you think about the cost of a water heater being approx $700, then this is a very good credit, but for a furnace that may cost $7,000 a $150 credit is paltry.

Energy-efficient building property Bio Mass Stoves, Heat Pumps, Central Air Conditioning, and Hot Water Heaters

Biomass Stove (burns plant derived fuel to heat your home or hot water) Although wood and wood pellet stoves are most common, biomass fuels includes renewable forms such as corn or even aquatic plants.

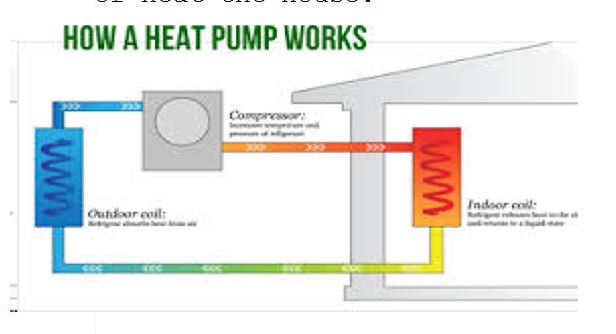

Air Source Heat Pumps. This device absorbs heat in one place and releases it as another either to cool or heat the house.

Maximum credit for Natural Gas, Propane, Oil, and Hot Water Furnaces or Boilers is $150. If there is an advance main air circulating fan then a credit is limited to $50.

Natural Gas, Propane, Oil Furnace or Hot Water Boilers

Gas Propane and Oil Furnaces and Fans

QUALIFIED ENERGY EFFICIENCY IMPROVEMENTS – ROOFS, WINDOWS, SKYLIGHTS, AND DOORS. Remember costs are multiplied by 10% to calculate credit.

Insulation

Roofs

Must meet

Energy Star req.

Windows, Doors & Skylights

Must meet Energy Star requirements

Maximum cost is $2,000 X .10 is $200.

RESIDENTIAL ENERGY CREDITS

B. For principal residence for either new or existing construction the following

Credit is 30% of cost with no limits

Fuel Cells. A machine that creates electricity by the interacting of hydrogen and oxygen.

There is a limit to the lower of 30% of the cost or the Kilowatt capacity X 1,000. So if you buy a Fuel cell system for 10,000 and it has a Kilowatt capacity of 2. The lower amount will be 2 X 1,000 or $2,000 and not the 3,000 amount ($10,000 X 30%)

C. For both new homes and existing homes qualify – and principal residence and 2nd homes qualify.

30% of cost with no limit on the following:

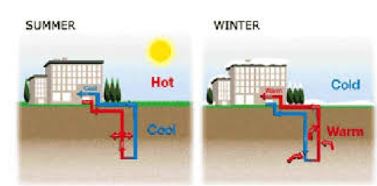

Geothermal Heat Pumps

Small Wind Turbines (Residential)

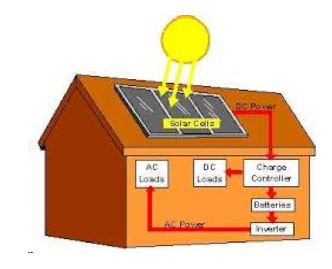

Solar Energy Systems (Water or Heating)

The IRS form to claim a credit is form 5695. As typical these credits are subject to almost yearly renewal. So you may want to do energy conservation in 2016 because you don’t know is Congress will renew. The one exception is for Geothermal, Wind, and Solar the 30% credit is through 12/31/19, and then is reduced to 26% for 2020,and then drops to 22% in 2021 the final year.